DRAMeXchange: Blackout at Samsung’s Fab Will Not Affect Commodity DRAM Prices in Q1

2021-06-11 09:43

124

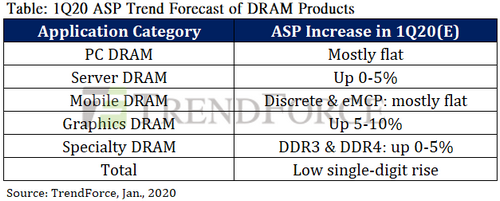

The power outage itself and subsequent disruption of production at Samsung’s Line 13 fab did not notably impact global supply of commodity DRAM, so DRAMeXchange is not expecting DRAM makers to increase their quotes because of that. In fact, to evade a potential hit from US tariffs on Chinese imports, PC makers produced more computers than they needed back in the fourth quarter and shipped them to the USA. As a result, their production will be lower than seasonally anticipated in Q1 2020.

However, because memory makers plan to limit increase of DRAM bit output this year and this could mean a supply-driven price hike, PC makers may be inclined to increase their memory buying in the first quarter to raise DRAM inventories while the prices are low (or at least predictable). Due to a behavior like that, commodity DRAM prices will stay flat or even increase when compared to the fourth quarter of 2019. To some degree, the incident at Samsung’s fab could make PC makers more willing to get DRAMs they need as soon as possible.

Samsung uses its Line 13 fab in Hwaseong, South Korea, to make specialty DRAM chips using 20 nm and 25 nm process technologies. Specialty memory is procured through quarterly lock-in deals, as opposed to the larger and more fluid trading that goes on for commodity DRAM. Notably, because of these differences, companies that consume specialty DRAM products do not proactively stock such devices, which means they are somewhat more exposed to disruptions and typically have to accept prices that they are offered. To that end, DRAMeXchange expects monthly contract prices on specialty DRAM to start increasing from this month and onwards.

The analysts also predict average selling prices of server DRAM and graphics DRAM to increase because demand for such memory devices has been growing since mid-December. Meanwhile, the market observers expect prices of mobile DRAMs to stay flat in the first quarter even despite imminent launch of next-generation handsets by various makers in Q1 and Q2.